Challenge

is a BtoB software designed to help financial players manage their cashflow forecasts (raised 100M).

In order to further help our users we undertook to build a new service designed to optimize the accounts payable department: Agicap Payment.

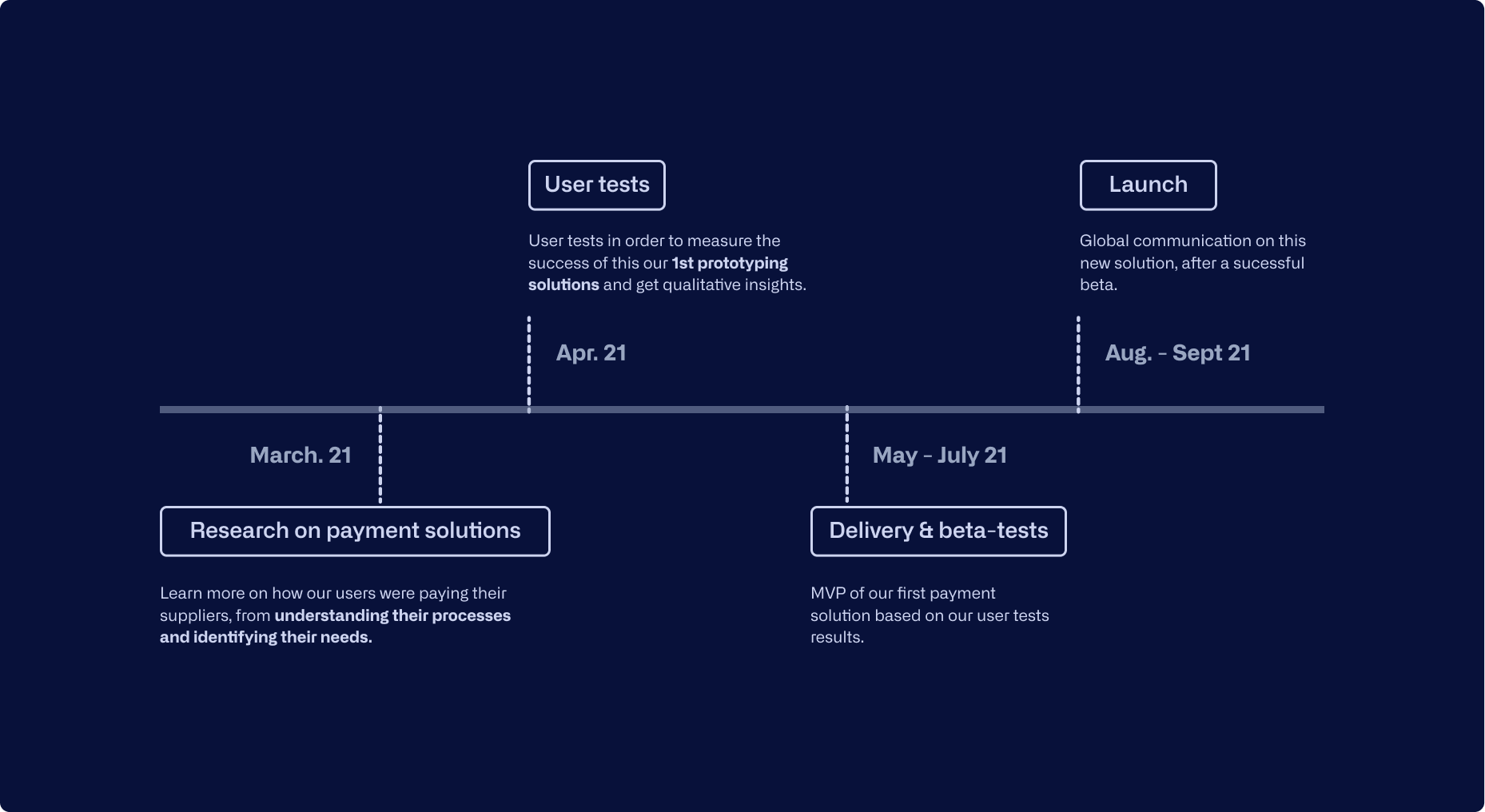

We firstly had to verify our users needs and interests and then launch a first Minimum Viable Product.

User research

Learnings

User interview learnings:

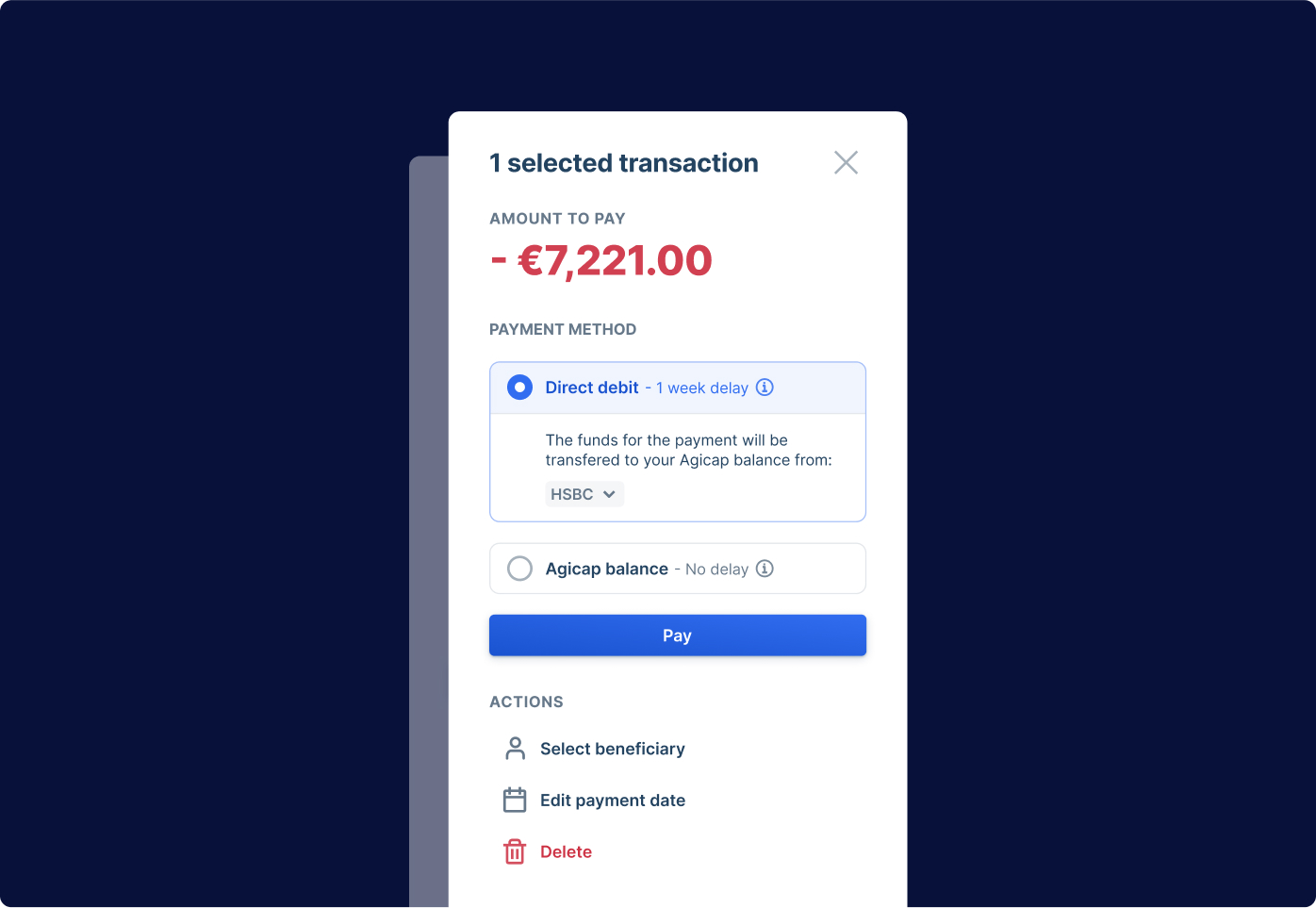

1. Various payment methods → time-consuming.

2. Supplier payments are mostly made by direct debit (70%) → automatization has a real impact.

3. A lot of payments are made late but not in advance → scheduling a payment is very useful.

Prototypes

I was responsible for creating user flows and collaborating with product managers to align our vision.

I then used Agicap's design system to create mock-ups and prototypes on Figma, which were tested with real users to evaluate the effectiveness of our MVP.

Through these tests, I ensured that we were delivering value to users and made necessary adjustments to our product design.

MVP

Based on our user tests, we were able to decide what would be into the MVP or not, to bring the minimum value possible towards our users.

• Send expected operations from Agicap cashflow forecast directly to payments.

• Schedule payment in order to save time.

• Select bulk payments

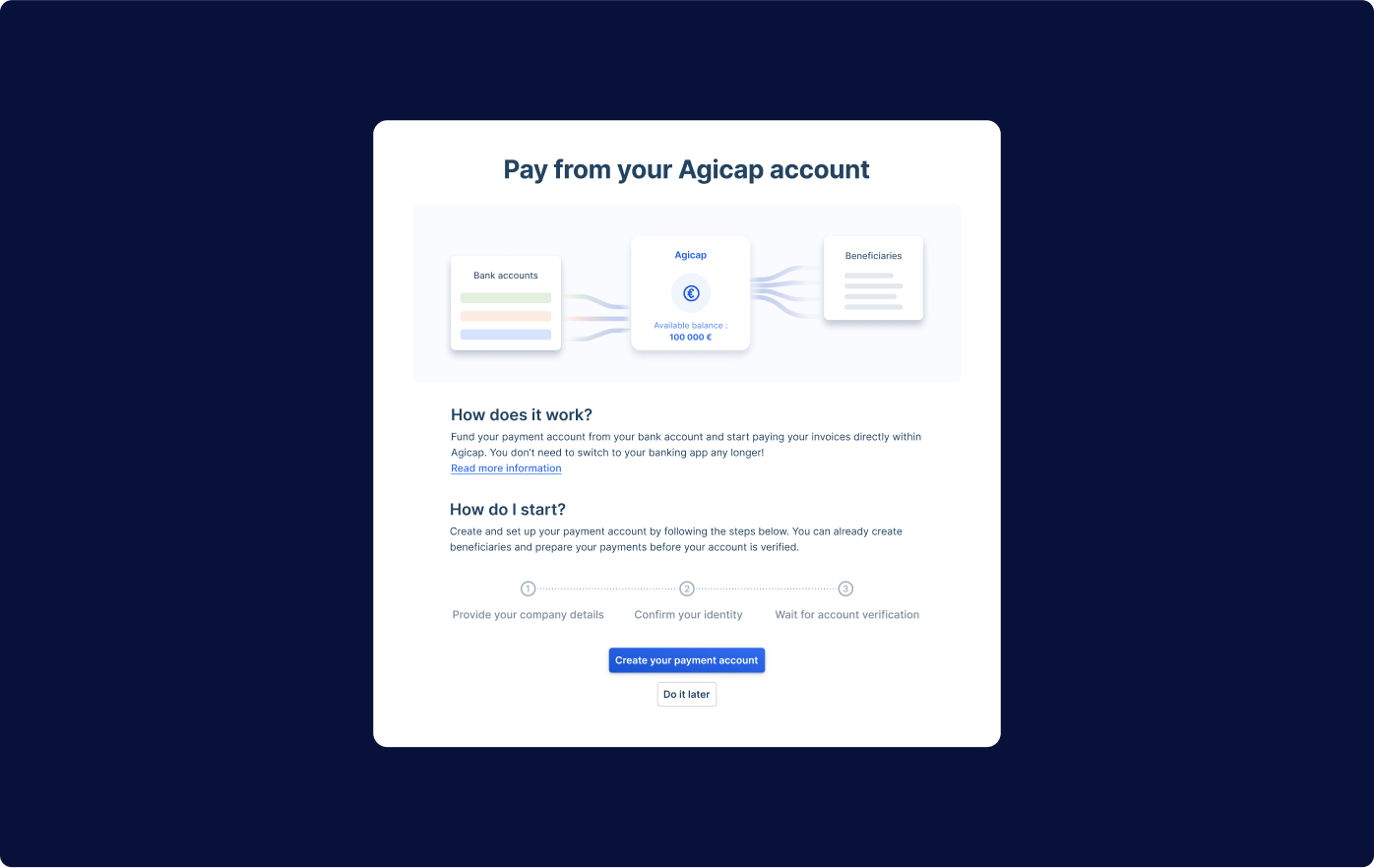

Partnership with Swan

To ensure a seamless payment experience for our users, we sought a collaborative partner who could provide an integrated payment solution. After careful consideration, we partnered with Swan, as it offered a highly flexible nocode service that allowed us to easily integrate their payment solution into our platform.

Prior to integration, we first implemented the necessary KYC and KYB processes for account creation.

Beta-testers

We had about 10 users that accepted to be beta testers. They tested the solution before the release to the public to ensure that they are free of bugs, have a good user experience, and meet the requirements and expectations.

This helped identify and fix any issues, improving its quality.

Key results

The project was a success as it resulted in an increase in usage from users. The release of the product was well received, and new developments were made soon after its release. These developments included the addition of payment options through XML and EBICS, in addition to the existing pivot account payment method.

These additions have likely contributed to deploy the product among its target audience.

Paid payments - by week (€)

€135,959,375

Entities with payment enabled

+ 1,890

Active rate

77%